As seen in

Money-related stress is impacting performance at work, causing many to leave for higher salaries elsewhere. As the cost of living crisis continues, employees are turning to the workplace for more support. When a pay rise isn’t an option, but you want to support your teams, what else can you do?

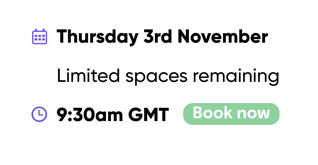

This webinar will cover both the psychological and financial elements that are impacting your employees' wellbeing, featuring two experts in their fields.

We'll give you real insights from the public about what they're looking for from their employers, so that you can provide useful resources in these challenging times.

What we'll cover:

|

The psychology of personal finances and how different people deal with money |

|

|

The emotions and rationale that guide a person's approach to finances |

|

|

|

How to get started with financial wellbeing support in your workplace |

|

|

How to encourage and grow financial resilience through a supportive work culture |

|

|

Breaking the taboo of talking about money at work |

|

|

Practical tips for supporting employees through the cost of living crisis |

%20(1).png)

A bit more about our speakers

Maarit Lassander

Psychotherapist and psychologist Maarit Lassander (MSci, PhD) has always been interested in the psychology of money. In 2020, she published a book called Money Wisdom where she explores how our childhood experiences and personality influence our approach towards financial issues, and gives concrete advice on how to develop healthier relationships towards money. Maarit has helped her clients for more than 10 years in her private practice and worked extensively in the Finnish healthcare system. She is an appreciated researcher at the University of Helsinki as well as a visiting researcher at the London School of Economics and Political Science.

Stacey Lowman

Stacey has 14 years of experience in the investment industry, working for global corporates, fintechs and startups. She has achieved multiple financial qualifications. Stacey became self-employed in 2018, setting up her own financial coaching business, with a focus on financial wellbeing and green money. She is also an Advisory Board Member for Money Movers, a national project to empower women to use their personal finances to tackle the climate crisis. Stacey works with individual coaching clients, as well as designing and delivering finance-related workshops and content for teams. Stacey was also a Career Coach and the Learning Designer for Escape The City, supporting people transitioning into purpose-driven work. Stacey joined Claro as their first Financial Coach in January 2021.

Claro helps you to improve the wellbeing of your employees by providing your team with peace of mind about their finances, confidence in their future and the necessary tools to achieve their all-important financial goals. With Claro's financial wellbeing platform, you can retain great employees, compete for talent and boost productivity.

.png?width=345&height=150&name=auntie_logo_RGB_auntie_logo%20(1).png)

Auntie is a preventative, solution-focused mental health service that supports employees handle stress and motivation-related challenges in everyday life before they become a crisis. When subscribing to Auntie, team members get access to a wide range of online mental health resources, and the option to book confidential 1:1 sessions with a qualified mental health professional.